TL;DR breakdown

- Officials in Bolangir, Odisha, uncovered a crypto scam. They arrested the main suspect. The scheme offered luxury trips for investments.

- Scammers stole more than $1.5 million with fake crypto deals. They set up a pyramid scheme. They launched a worthless digital currency to deceive investors.

- The Indian government is tightening crypto regulations and targeting illegal exchanges to protect investors from such scams.

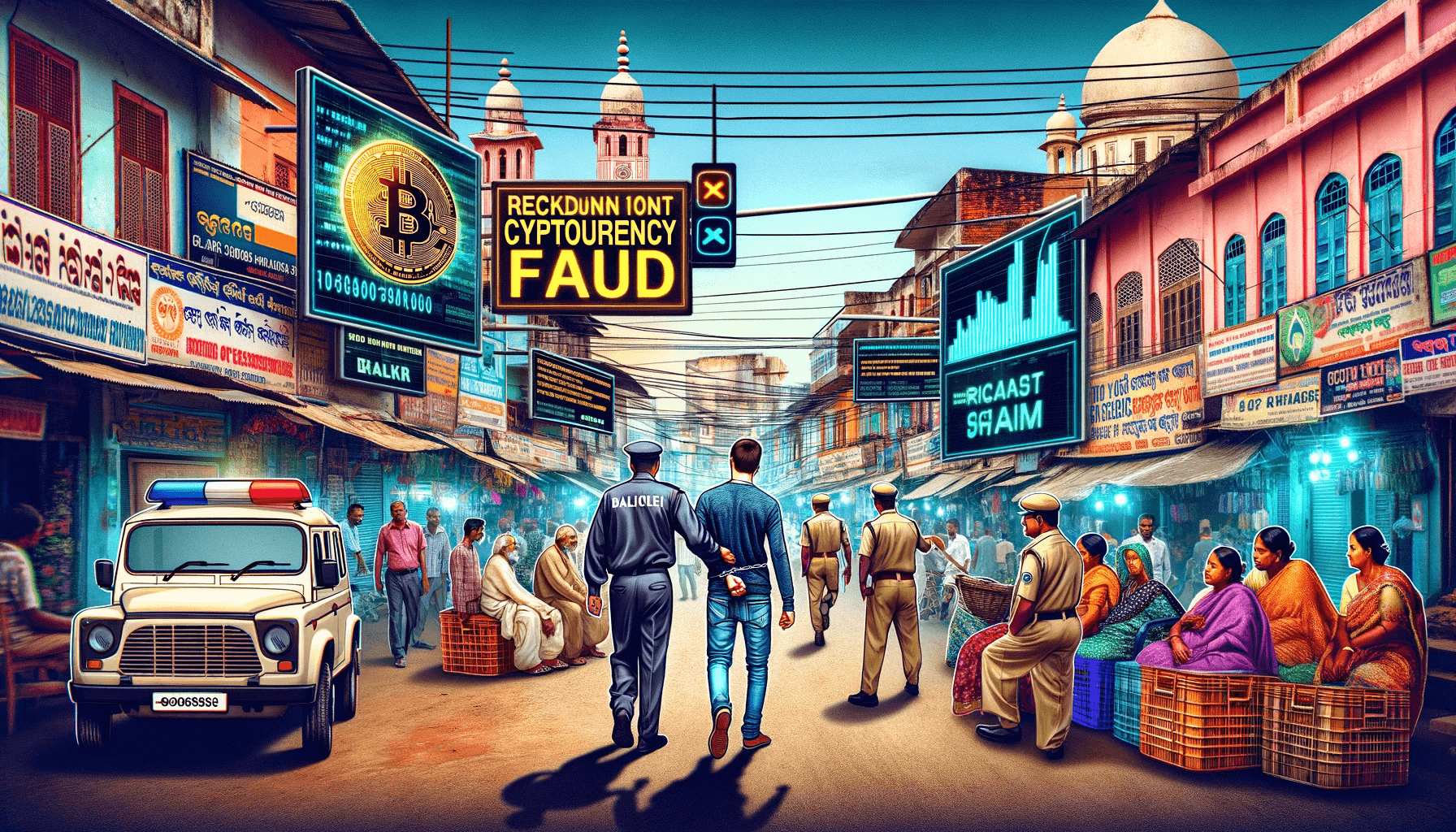

Authorities in Bolangir, Odisha, have exposed a complex cryptocurrency fraud. The scheme, which promised lavish trips in exchange for investment, has caught the eyes of investors and regulators alike. Local law enforcement’s latest efforts have led to the apprehension of a key suspect believed to be at the heart of this regional scam network.

Authorities Crack Down on Deceptive Practices

The operation, characterized by its cunning use of fake cryptocurrency deals, promised unsuspecting investors exotic destinations such as Thailand and Dubai. By exploiting various digital platforms, the fraudsters successfully siphoned over $1.5 million from their victims. They set up “Pegmatite Sustainable Solutions Private Limited” to launder money. It was a pyramid marketing scheme. This added to the complexity of their deceit.

An investigation into the group’s activities revealed a troubling pattern. In July 2022, they launched a virtual currency, initially priced at a mere $0.0012. They convinced investors of its escalated value to $0.010 through manipulative claims, leading to significant financial losses for those duped.

A Rising Challenge for Indian Investors

This incident sheds light on the increasing susceptibility of Indian investors to cryptocurrency fraud. The root causes are manifold: relaxed regulations, a lack of experience among investors, and a general misunderstanding of digital asset platforms. The Telegram app has become a popular tool for fraud. This shows the need for more awareness and caution among digital asset investors.

In response to the growing threat, the Indian government has stepped up its regulatory efforts. The Financial Intelligence Unit (FIU) has taken action against nine offshore cryptocurrency exchanges, issuing show-cause notices for illegal operations and anti-money laundering law violations. Adding digital assets to India’s anti-money laundering watch list is a major step in tightening control over the cryptocurrency market.

The Path Forward

The unfolding situation in Bolangir underscores the critical need for vigilance among investors and robust regulatory measures to safeguard against cryptocurrency fraud. As the digital asset landscape continues to evolve, the Indian government’s proactive stance offers a blueprint for mitigating risks and protecting the interests of investors. This case highlights the challenges facing the cryptocurrency sector and the concerted efforts required to ensure a secure and transparent investment environment.

Related: Elon Musk’s X Payments and Potential Impact on Dogecoin