TL;DR breakdown

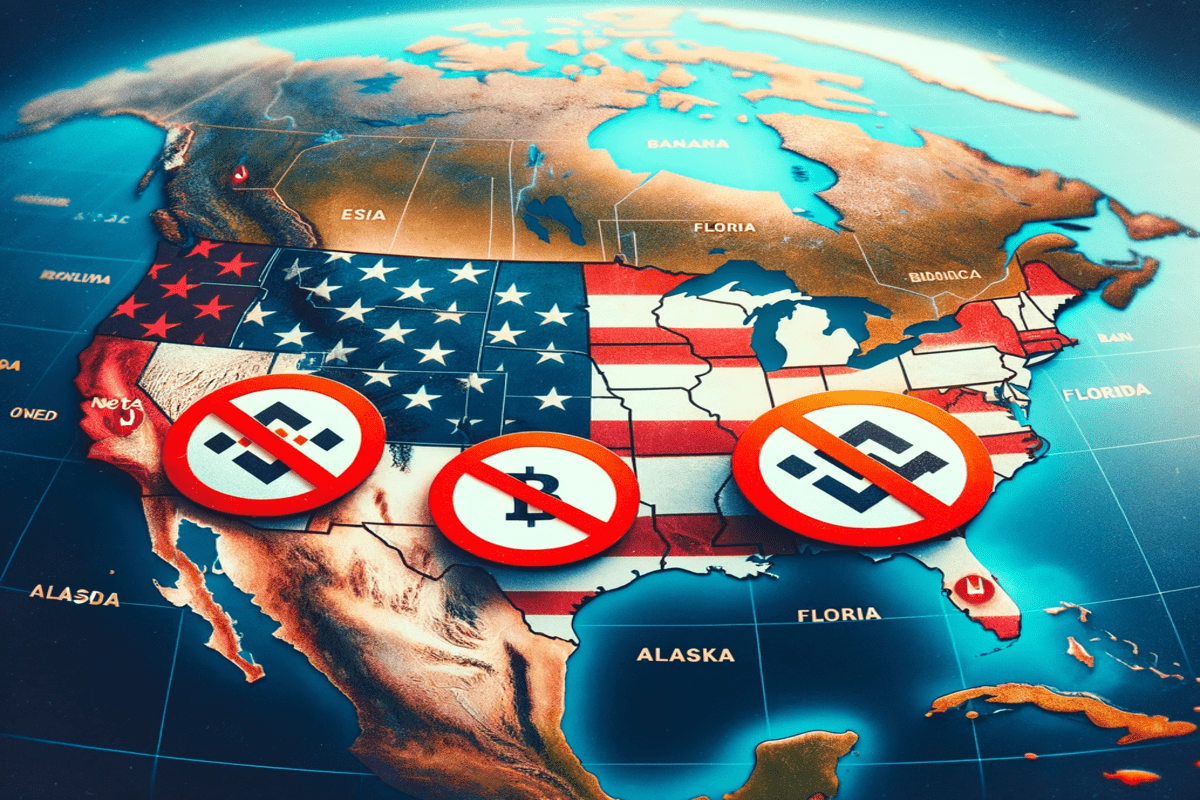

- Binance US stopped its services in Florida and Alaska due to regulatory challenges. This reflects the strict approach of these states towards crypto exchanges.

- The company is at a crucial point as its license nears expiration, and its CEO faces legal issues. This situation underscores the importance of adopting a new strategy in the US.

- The situation with Binance US could influence how the entire cryptocurrency market deals with regulation, emphasizing the fine line between innovation and compliance.

Binance US, the US division of the global crypto exchange Binance, faces regulatory hurdles. It has halted its operations in Alaska and Florida. With the US Department of Justice intensifying its scrutiny and the recent exit of CEO Changpeng Zhao, the company is in turmoil.

Florida and Alaska Tighten the Noose

Florida’s regulatory authorities have implemented an emergency suspension of Binance US’s operations, citing risks to public health, safety, and welfare. This decisive action underlines the state’s commitment to safeguarding the public interest while ensuring procedural fairness. The Office of Financial Regulation highlights its critical worries about “BAM Trading,” the operator of Binance US. They refer to section 120.60(6) of the Florida Statutes to stress the importance.

Simultaneously, Alaska has denied renewing Binance US’s operating license, adding to the company’s regulatory woes. While specific reasons remain undisclosed, this move signals a firm stance on compliance and regulatory adherence in cryptocurrency.

Navigating Uncertain Waters

The backdrop to these regulatory challenges is the looming expiration of Binance US’s money services business license, set for April 30, 2024. The situation is further complicated by legal issues facing Changpeng Zhao associated with the company’s anti-money laundering protocols. These developments mark a critical juncture for Binance US, emphasizing the need for a strategic pivot to regain footing in the US market.

Engagement with regulatory bodies appears to be the pathway forward for Binance US. The cryptocurrency exchange must address the concerns raised by authorities to resume operations and restore trust among users and investors. This scrutiny period comes when the cryptocurrency industry is under a global microscope, with regulatory frameworks evolving to keep pace with technological advancements.

The Ripple Effect on the Cryptocurrency Industry

The industry watches closely as Binance US’s regulatory saga unfolds. These actions and how the company reacts may create a model for crypto exchanges in strict regulatory settings. This could shape future standards. Investors and stakeholders are reminded of the importance of compliance and the potential impact of regulatory actions on the future landscape of digital currencies.

As Binance US charts its course through these challenges, the broader cryptocurrency market awaits the outcomes, which could influence regulatory approaches and market dynamics in future years. The situation underscores the delicate balance between innovation and regulation, a theme dominating discussions in the fast-evolving cryptocurrency sector.

Related: Ripple vs SEC Latest Updates in the Ongoing Legal Battle

Discover more from The African Crypto

Subscribe to get the latest posts to your email.