Estimated reading time: 6 minutes

Cryptocurrency trading can be a rollercoaster ride, with prices soaring one moment and plummeting the next. To navigate this volatile market successfully, traders need all the help they can get. One crucial tool that traders use to their advantage is the concept of supply and demand zones.

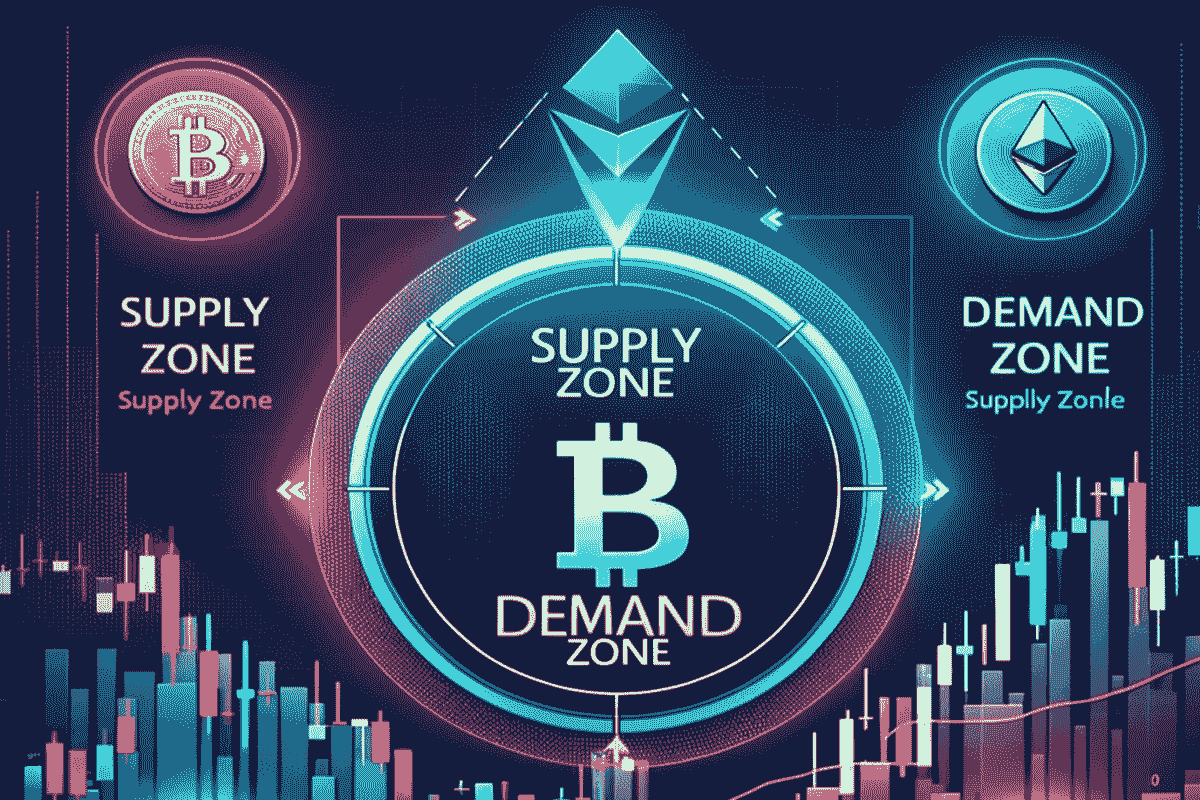

At the core of every market, including the cryptocurrency market, lies the fundamental concept of supply and demand. In crypto trading, supply represents the number of sellers and their activity, while demand signifies the number of buyers and their activity.

When demand outweighs supply, prices tend to rise, and when supply surpasses demand, prices tend to fall.

Table of contents

Supply and Demand Zones Defined

Supply and demand zones are critical components of technical analysis used by traders to optimize their trading strategies. These zones represent areas of consolidation on price charts, typically occurring before significant price movements, either upwards or downwards.

Supply Zone: In a supply zone, the supply of a cryptocurrency exceeds the demand. This results in an excess supply, causing prices to fall, and is typically indicated by a downtrend on a price chart.

Demand Zone: Conversely, a demand zone is where the demand for a cryptocurrency surpasses its supply. This leads to an excess demand, causing prices to rise, and is typically indicated by an uptrend on a price chart.

These zones can signal potential market reversals or the continuation of existing trends. They are especially important in a market influenced by crypto whales and institutional investors, where identifying trends may not be as straightforward.

Types of Supply and Demand Zones

Understanding the different types of these zones is crucial for traders, as they have implications for investment decisions. Here are some key patterns to be aware of:

Reversal Patterns

Drop Base Rally (Bullish): This pattern involves a price moving downward, then stabilizing around a particular level (the base) before rallying upward due to high demand.

Rally Base Drop (Bearish): In contrast, the rally base drop pattern sees a price moving upward, creating a base, and then dropping downward due to high supply.

Continuation Patterns

Continuation patterns indicate that a cryptocurrency price tries to break through a pattern but ultimately continues its existing trend. These patterns have less momentum than reversal patterns and are usually less favorable for investors.

Drop Base Drop: In this pattern, the price drops, pauses its downward trend to create a base, and then continues the solid downward trend.

Rally Base Rally: Here, the price rises, pauses its upward trend to create a base, and then continues the solid upward trend.

Identifying Supply and Demand Zones

Market shifts and imbalances between these zones are the key factors in creating supply and demand zones. Traders often look for larger candles, known as explosive price candles or extended range candles (ERCs), to identify these zones. These candles typically have longer bodies with small wicks.

Green ERCs: These candles indicate strong market demand and rising prices, signifying a demand zone.

Red ERCs: On the other hand, red candles suggest strong market supply and falling prices, indicating a supply zone.

Additionally, traders use various technical analysis indicators, such as pivot points, Fibonacci levels, and support and resistance levels, to pinpoint these zones accurately.

Leveraging Supply and Demand Zones in Crypto Trading

Effective use of these zones requires traders to grasp trading strategies and technical analysis. Traders typically mark these zones on price charts and identify associated support, resistance, and Fibonacci levels.

Their choice of strategy depends on their risk tolerance, with options including range-trading or breakout strategies.

Risks Associated with Supply and Demand Crypto Trading Strategies

While supply and demand zones are valuable tools for traders, they come with specific risks:

False Breakouts: Prices can break through a supply or demand zone and then suddenly reverse direction, often due to market manipulation or low trading volume.

News and Market Sentiment: Supply and demand zone trading relies heavily on technical analysis and may overlook fundamental analysis or sudden shifts in market sentiment. News or market events can quickly render analysis based on these zones obsolete.

Overreliance: It’s essential to use supply and demand zone analysis in conjunction with other technical and fundamental indicators to confirm market moves accurately.

Risk Management is Key

In the world of cryptocurrency trading, risk management is paramount. Traders aim to profit by shorting in supply zones or taking long positions in demand zones.

This strategy involves selling when demand is strong and prices are high and buying when supply is ample and prices are low, capitalizing on price fluctuations to generate profit.

However, meticulous risk management is essential. This includes setting stop-loss orders for all trading situations, protecting both long and short positions, ensuring safe entry points for breakout buys, and mitigating potential losses during swing trading.

Conclusion

Understanding the fundamental principles of supply and demand in crypto trading sets the stage for grasping the power of supply and demand zones. These zones, often overlooked by novice traders, can reveal hidden treasures within price charts, providing a roadmap for potential market movements.

Supply and demand zones come in various forms, from reversal to continuation patterns. Each carries its own set of implications for traders, and recognizing these patterns can be the difference between profit and loss.

Whether it’s spotting the telltale signs of explosive price candles or using pivot points and Fibonacci levels as guides, mastering the art of supply and demand zone identification is a valuable skill.

Leveraging these zones in your trading strategy isn’t just about marking them on a chart; it’s about understanding how they fit into the broader context of your trading plan. It’s about knowing when to go long in demand zone and when to go short in supply zone, all while meticulously managing risk.

However, it’s crucial to be aware of the potential pitfalls. False breakouts, unexpected news events, and overreliance on these zones can lead to losses.

Therefore, traders should use zones as part of a comprehensive trading toolkit, combining them with other indicators and sound risk management practices.

Supply and demand zones aren’t just technical analysis tools; they are your companions in the complex journey of cryptocurrency trading. With diligence, practice, and a well-rounded approach to trading, you can harness the power of these zones to navigate the crypto market with confidence and make the most of its ever-shifting dynamics.

Remember, the path to success in crypto trading is paved not just with knowledge but with a keen understanding of how to use that knowledge effectively.

FAQs

Supply and demand zones are areas of consolidation on cryptocurrency price charts, signifying periods of excess supply or demand before significant price movements.

Traders use these zones to identify potential market reversals or trend continuations, helping them make informed trading decisions.

Common patterns include drop base rally (bullish), rally base drop (bearish), drop base drop, and rally base rally, each indicating different price movements.

Traders look for larger candles, known as explosive price candles or ERCs, and utilize technical analysis indicators such as pivot points, Fibonacci levels, and support and resistance levels.

Risks include false breakouts, reliance solely on technical analysis, and the impact of news or market sentiment shifts.

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.