Estimated reading time: 10 minutes

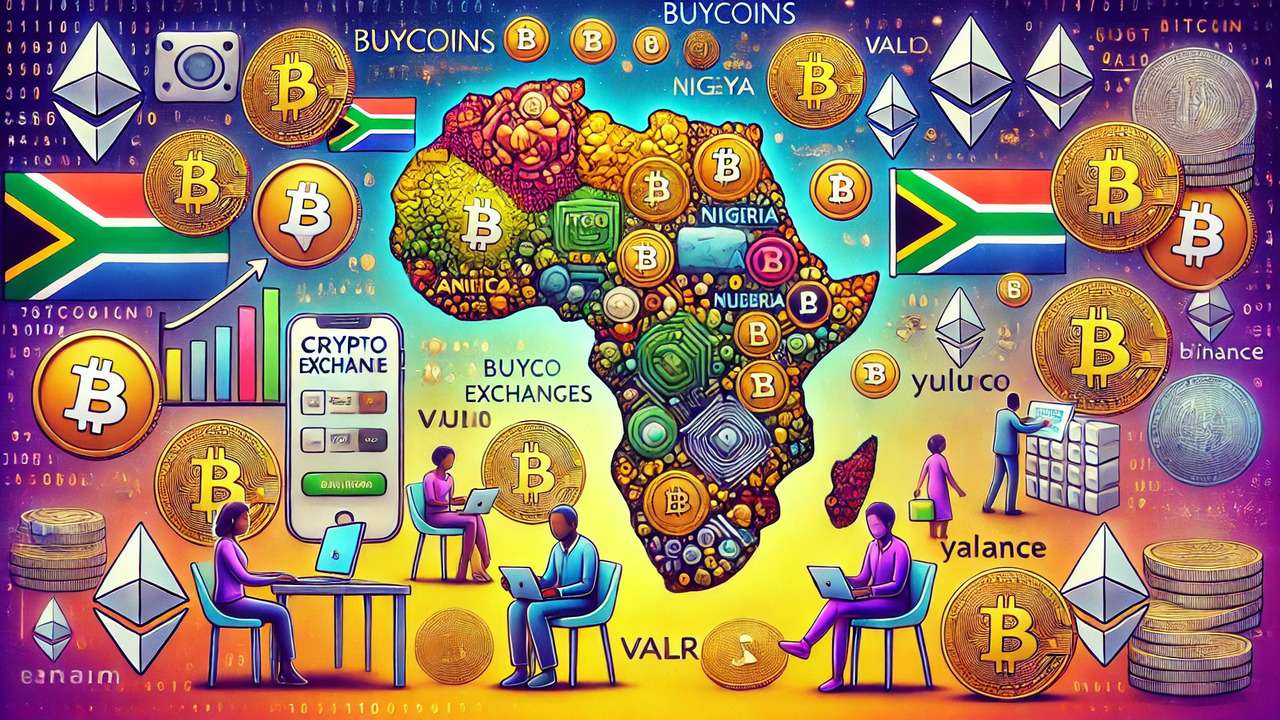

The cryptocurrency market in Africa is experiencing rapid growth, driven by unique socio-economic factors. High mobile penetration and significant remittance flows, coupled with the limitations of traditional banking systems, have made digital currencies an appealing alternative. Countries like South Africa, Nigeria, and Kenya are leading the way in crypto adoption, thanks to their integration of mobile money systems such as M-Pesa, which have set the stage for a more seamless transition to digital currencies.

Economic challenges like inflation and currency devaluation have also driven individuals and businesses in regions like Nigeria and Zimbabwe to turn to cryptocurrencies as a stable means of transaction and store of value. Using digital currencies offers a hedge against economic instability and provides cheaper and more efficient transaction methods than conventional currencies.

Table of contents

The Role of Crypto Exchanges in Africa

Crypto exchanges are important in Africa’s digital currency landscape as the main platforms for converting fiat currencies into cryptocurrencies. They enable the buying, selling, and trading of cryptocurrencies, making them accessible to a broad audience, from professional traders to everyday users. These exchanges are particularly important for financial inclusion, offering services that bridge the gap between traditional financial systems and digital innovations. They facilitate lower transaction fees, especially for remittances, which are crucial in a continent with some of the highest remittance costs globally.

By providing easier access to digital currencies and supporting local payment methods, crypto exchanges empower Africans to engage in the global economy, secure their financial well-being, and navigate the challenges of their local economies.

Also read: Crypto Investors Incur $567M in Liquidations as Bitcoin Declines

Major Crypto Exchanges in Africa

The African cryptocurrency market features several key players, each offering unique services tailored to the needs of the continent’s diverse economic landscape:

BuyCoins

Dominating the Nigerian market, BuyCoins offers a seamless trading experience with zero fees on transactions, trading, and deposits. It does, however, charge a withdrawal fee. Unique to Nigeria, BuyCoins caters specifically to Nigerian traders, ensuring its services are highly optimized for local needs. This focused approach allows it to maintain a strong presence in one of Africa’s most vibrant economies.

Luno

Luno is a well-established platform in over 40 countries, including South Africa. It is celebrated for its user-friendly interface, which supports major cryptocurrencies like Bitcoin and Ethereum. Luno’s broad geographic reach and easy-to-use platform make it a favorite for beginners and seasoned traders looking to navigate the crypto space efficiently.

VALR

As the largest exchange in South Africa by trading volume, VALR offers various cryptocurrencies alongside competitive fees. Its platform is designed to be user-friendly, catering to the needs of both novice traders and experienced professionals. This balance of accessibility and depth in services has helped VALR secure a top spot in the South African market.

Yellow Card

Known for its simplicity and low fee structure, Yellow Card serves a pan-African audience, simplifying the crypto purchase process. Its commitment to ease of use makes it particularly appealing to new entrants in the cryptocurrency market across Africa, who are looking for straightforward and cost-effective trading solutions.

Binance

Binance stands out as the largest global crypto exchange operating in Africa. It offers extensive language support, including English and Afrikaans, and provides a wide range of trading options from spot to futures trading. Fully regulated and licensed in South Africa, Binance brings a high level of security and a broad suite of services, making it a go-to platform for traders across the continent.

Also read: FSCA Investigates 30 Unregistered Crypto Operations in South Africa

Features of Leading Crypto Exchanges in Africa

The leading crypto exchanges in Africa each offer distinct features designed to meet the diverse needs of their user bases. Here’s an overview of key features such as security measures, user interface, and customer support, along with fee structures and cryptocurrency support:

Security Measures

BuyCoins: Ensures security through features like two-factor authentication (2FA) and stores cryptocurrencies in cold storage to protect users’ assets from online threats.

Luno: Highly secure; Luno uses deep freeze storage, multi-signature wallets, and 2FA to ensure the safety of user funds.

VALR: Known for robust security measures, VALR also employs cold storage for the majority of user assets, 2FA, and custom withdrawal permissions to enhance security.

Yellow Card: Focuses on security with 2FA and encryption protocols to protect the transaction and user data.

Binance: Offers an extensive set of security features, including device management, address allowlisting, and internal risk controls alongside its Secure Asset Fund for Users (SAFU) to cover loss in extreme cases.

User Interface

BuyCoins and Yellow Card are known for their simplicity, which is designed to make the buying and selling process as straightforward as possible for users at all levels.

Luno and VALR boast interfaces that balance simplicity with comprehensive tools, catering to both new and experienced traders.

Binance provides a more complex interface with advanced charting tools, trade history, and detailed order books suitable for experienced traders.

Customer Support

Luno offers extensive support through a help center, live chat, and email support.

VALR and Binance provide round-the-clock customer service with live chat features.

BuyCoins and Yellow Card focus on accessibility and ease, offering support through direct channels like email and social media platforms.

Fee Structures

BuyCoins: Offers zero fees on transactions and trading but imposes a withdrawal fee.

Luno: Typically charges a fee based on the user’s 30-day trading volume, with fees decreasing as volume increases.

VALR: Known for competitive fees, especially for market makers who add liquidity to the market.

Yellow Card: Charges minimal fees, aiming to make crypto accessible at the lowest possible cost.

Binance: Offers a tiered fee structure based on trading volume and BNB balance, with additional discounts for using Binance Coin (BNB).

Types of Cryptocurrencies Supported

BuyCoins primarily supports major cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

Luno and VALR support a range of cryptocurrencies, including Bitcoin, Ethereum, Ripple, and more.

Yellow Card focuses on key currencies like Bitcoin, Ethereum, and Tether.

Binance supports a broad spectrum of over 350 cryptocurrencies, catering to diverse trading needs and preferences.

Also read: Planet Mojo’s Summer Surge Event Offers Big Rewards: $25,000 USDC and 1 Million MOJO Tokens

Regulatory Challenges and Economic Conditions

Regulatory Challenges: Cryptocurrency trading in Africa faces significant regulatory hurdles. Various African governments have fluctuating stances on crypto, with some, like Nigeria, initially banning bank transactions for crypto-related activities, only to later seek ways to establish a regulatory framework. The lack of consistent regulations can create uncertainties that may discourage investment and innovation in the crypto sector.

Economic Conditions: Economic instability in many African countries, characterized by high inflation rates and currency devaluation, significantly impacts crypto trading. While these conditions can drive the adoption of cryptocurrencies as a hedge against inflation, they also pose challenges, such as increased volatility in crypto markets and heightened risks for investors.

Tips on Selecting a Reliable Exchange

Assess Security Measures: Opt for exchanges that offer robust security protocols like two-factor authentication, cold storage options for asset protection, and regular security audits. Ensuring that an exchange prioritizes user security can mitigate risks associated with cyber threats.

Understand Fee Structures: Examine the fee structures of potential exchanges. Look for transparency in fees for deposits, withdrawals, and trading. Some exchanges offer lower fees for higher trading volumes or discounts when using their native tokens.

Range of Supported Cryptocurrencies: Consider exchanges that support a wide range of cryptocurrencies. This offers more trading opportunities and indicates an exchange’s commitment to providing diverse trading options to its users.

User Interface and Customer Support: A user-friendly interface is crucial, especially for new traders. Additionally, reliable customer support that can address issues promptly is vital. This includes multiple contact methods, such as email, phone, and live chat.

Regulatory Compliance: Choose exchanges that comply with local regulations. This compliance ensures that the exchange operates within legal boundaries and provides a level of security for traders.

Market Reputation: Research the exchange’s reputation within the crypto community. Reviews and feedback from other users can provide insights into the exchange’s reliability and overall performance.

Also read: Trump Could Be Considering Bitcoin as a Reserve Asset

Potential Growth of the Cryptocurrency Market in Africa

Africa’s cryptocurrency market is poised for substantial growth, driven by several key factors that make it a ripe environment for digital financial expansion. Rapid improvements in mobile internet connectivity have allowed more Africans to participate in the digital economy, leading to an intertwining of mobile wallets and cryptocurrencies. This connectivity facilitates easier access to the crypto space, broadening its appeal and utility.

The continent’s economic instability, characterized by high inflation and currency volatility, makes cryptocurrencies an attractive alternative. They offer a more stable avenue for financial preservation and value maintenance, which could boost their demand. Additionally, Africa experiences a high volume of remittances. Cryptocurrencies are more cost-effective and quicker than traditional banking systems, which are often burdened with high fees.

Africa’s youthful population is generally more receptive to adopting new technologies, including cryptocurrencies. This demographic trend supports the broader and faster adoption of such technologies.

The evolving regulatory landscape also plays a crucial role. As African countries develop clearer cryptocurrency regulations, exchanges that comply with these regulations are likely to gain a competitive advantage. Being able to navigate these laws effectively will attract users who prioritize security and legitimacy.

Moreover, exchanges that tailor their services to meet local needs, such as supporting local currencies and mobile payment methods, will likely dominate the market. The integration of decentralized finance (DeFi) services could further transform the crypto exchange landscape in Africa, attracting a substantial user base, especially among the tech-savvy and financially underserved populations.

Finally, educational initiatives by exchanges to demystify cryptocurrency and blockchain technology could spur greater adoption. By investing in user education, exchanges can lower entry barriers and establish themselves as African market leaders.

Conclusion

The crypto exchanges like BuyCoins, Luno, VALR, Yellow Card, and Binance are crucial in developing the African cryptocurrency sector. These platforms enhance market accessibility, making digital currencies available to a diverse range of users across Africa, from novices to seasoned traders. Additionally, they play a key role in economic empowerment by providing alternative financial stability and improving remittance processes, which contributes to broader financial inclusion on the continent.

Moreover, these exchanges successfully navigate local market demands and regulatory frameworks, which helps stabilize the African crypto market and fosters user trust. Their efforts advance technological and financial services and serve as vital connectors between traditional financial systems and the evolving digital currency space.

For newcomers eager to explore crypto trading in Africa, starting by learning the basics of cryptocurrency and blockchain technology is essential. Opt for exchanges that prioritize security, ease of use, and strong customer support, and start trading with small amounts to minimize risk. Keeping abreast of market and regulatory developments can also guide better investment decisions, while adopting stringent security measures, like using robust passwords and enabling two-factor authentication, will help safeguard your investments.

Also read: Bahamas Pushes Sand Dollar Integration in Banks to Offer Digital Currency

FAQs about the largest crypto exchange in Africa

The top exchanges include Binance, known for its extensive range of services and global reach; Luno, popular for its user-friendly platform; VALR, which boasts the largest trading volume in South Africa; and local favorites like BuyCoins and Yellow Card, known for their tailored services to the African market.

Consider factors such as security features, fee structure, range of supported cryptocurrencies, user interface, and customer support. It’s also important to choose exchanges that comply with local regulations and have a good reputation in the market.

The legality of cryptocurrencies varies by country. Some African nations have embraced them, while others have restrictions or have not yet established clear regulations. Always check the current legal status in your specific country before trading.

Ensure the exchange uses strong security measures like two-factor authentication, cold storage for the majority of the funds, SSL encryption, and regulatory compliance to protect users’ assets.

Start by educating yourself about cryptocurrencies and blockchain technology. Choose a reputable exchange that supports your local currency and payment methods. Begin with small investments to gain understanding and confidence and stay informed about market trends and regulatory updates.

Also read: Galaxy’s Mike Novogratz Outlines US Crypto Legislation Trends

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.