Estimated reading time: 8 minutes

Peer-to-peer (P2P) lending is a modern financial practice that enables individuals to borrow or lend money to each other directly through online platforms, bypassing traditional banks. These platforms serve as intermediaries, where borrowers request loans and individual lenders provide the funds.

P2P lending offers distinct advantages compared to conventional banking systems, making it an innovative and popular way for individuals to earn passive income while facilitating financial transactions among peers.

Table of contents

Understanding Peer-to-Peer Lending

Roles of Borrowers and Lenders

Borrowers, whether individuals or businesses seeking loans, create detailed loan listings outlining their specific needs. These listings include loan amount, purpose, and offered interest rates. Lenders evaluate borrower creditworthiness to assess lending risk.

On the other hand, lenders are individuals looking to invest and generate returns. They review loan listings, assess borrower profiles, and select loans to fund. Some opt for diversification, spreading investments across multiple loans to mitigate risks.

Benefits of P2P Lending

Higher Potential Returns: P2P lending often offers lenders higher interest rates than traditional savings accounts or investment options, potentially leading to more substantial investment returns.

Direct Interaction: Peer-to-peer lending allows direct interaction between borrowers and lenders, eliminating the need for intermediaries. This transparency and control appeal to both parties.

Diversification: Lenders can diversify their investment portfolio by participating in multiple loans with varying risk levels, reducing the impact of defaults.

Transparency: P2P lending platforms are known for their transparency, providing detailed information about borrowers and loan listings enabling lenders to make informed decisions.

Getting Started with P2P Lending

Steps to Get Started as a P2P Lender

Research and Education: Begin by researching P2P lending and its mechanisms. Understand the risks and benefits associated with this investment. Educate yourself on how the lending process works.

Financial Assessment: Evaluate your financial situation. Determine how much you can comfortably invest in P2P loans. Lending platforms may have minimum investment requirements.

Choose a P2P Platform: Select a reputable P2P lending platform. Look for platforms that have a track record of success, transparent fee structures, and strong borrower screening processes.

Account Setup: Create an account on your chosen P2P lending platform. Provide the required personal and financial information. Ensure that you comply with any identity verification procedures.

Deposit Funds: Transfer the funds you intend to lend into your P2P lending account. Most platforms offer various payment options for depositing funds.

Browse Loan Listings: Explore available loan listings on the platform. Review borrower profiles, loan terms, and interest rates. Diversify your investments by considering multiple loans.

Lend Wisely: Start by making smaller investments to minimize risk. Gradually increase your lending portfolio as you become more comfortable with the platform and its processes.

Choosing a Reliable P2P Lending Platform

When researching P2P lending platforms, thorough comparison is key. Start by reading user reviews for insights on different platforms. Evaluate each platform’s track record in facilitating successful loans to gauge reliability.

Transparency matters for informed investments. Choose a platform with clear borrower, loan, and fee information. Transparency builds trust and aids risk assessment.

Due diligence is crucial. Understand a platform’s borrower vetting procedures, including credit checks and risk assessments. This reduces default risks and enhances reliability.

Check regulatory compliance in your region. Platforms adhering to regulations commit to ethics and create a safe lending environment. Prioritize legally compliant platforms to mitigate risks.

Importance of Due Diligence

Due diligence is vital in assessing borrower creditworthiness, enabling lenders to spot risky loans and make informed investment decisions. Thorough due diligence reduces lending risk to potential defaulters, safeguarding investments. Additionally, it helps protect lenders’ returns and ensures a stable income stream from P2P lending.

Strategies to Maximize Passive Income through P2P Lending

Diversification for Risk Reduction

Diversifying investments across multiple loans is a fundamental strategy. It spreads risk and minimizes the impact of any single loan default. Lenders lending to borrowers with different risk profiles increase their chances of earning consistent returns.

Auto-Investing for Efficiency

Utilizing auto-investing tools offered by P2P lending platforms can streamline the lending process. Auto-investing automatically allocates funds to available loans based on predefined criteria. This ensures that funds are continuously invested, optimizing the potential for passive income generation.

Reinvestment for Compound Growth

Reinvesting earned interest and principal repayments accelerates passive income growth. Compound interest allows lenders to earn interest on their earnings, leading to exponential income growth. This strategy compounds the benefits of P2P lending, especially for long-term investors.

Selective Lending for Risk Management

Being selective about the loans to fund is essential. Conduct thorough due diligence on borrowers’ creditworthiness and loan details. Avoid high-risk loans and focus on those that align with your risk tolerance and investment goals. Quality over quantity is key.

Regular Monitoring and Adjustments

Passive income from P2P lending requires ongoing monitoring. Stay updated on loan statuses and borrower behavior. If a loan becomes high-risk or defaults, take necessary actions promptly, such as selling the loan on secondary markets or pursuing collections.

Platform Research and Selection

Choose P2P lending platforms carefully. Research and compare platforms based on their track record, transparency, fees, and borrower screening processes. Opt for platforms with a history of successful loans and a commitment to investor protection.

Portfolio Management and Risk Assessment

Regularly assess the performance of your P2P lending portfolio. Adjust your investment strategy as needed to maintain a balanced and diversified portfolio. This proactive approach helps safeguard your passive income stream.

Related: What is Address Poisoning in Crypto and How to Avoid Them?

Risks and Mitigations in P2P Lending

Common Risks in P2P Lending

Credit risk is a primary concern in peer-to-peer (P2P) lending. Borrowers defaulting on loans can lead to financial losses for lenders. This risk arises when borrowers fail to repay, causing expected returns to fall short.

Platform risk is also significant. Lenders risk losing their investments if a P2P lending platform faces financial trouble or bankruptcy. The platform’s stability and financial health are vital for lenders’ security.

Interest rate risk is another factor. Fluctuating interest rates can affect P2P lending returns. Rising rates can reduce the attractiveness of P2P lending, impacting profitability.

Liquidity risk is key. Selling P2P loans on secondary markets can be challenging, limiting investment liquidity. This affects lenders’ flexibility to exit investments quickly.

Investors should mitigate these risks. Diversification, due diligence, and staying informed about market conditions are essential practices to manage and minimize these inherent risks in P2P lending.

Mitigating Risks

Diversification: Lenders can spread their investments across multiple loans and borrowers. Diversification reduces the impact of defaults on overall returns.

Due Diligence: Conduct thorough borrower assessments to minimize credit risk, including checks and income verification.

Platform Research: Choose reputable P2P lending platforms with a track record of successful loans and a commitment to investor protection.

Loan Selection: Be selective when choosing loans to fund. Focus on loans that align with risk tolerance and investment goals.

Auto-Investing: Consider using auto-investing tools provided by platforms to ensure funds are continuously invested, enhancing returns.

Loan Monitoring: Regularly monitor loan statuses and borrower behavior. Take prompt action in case of defaults or high-risk loans.

Importance of Reliable Platforms

Choosing a reliable P2P lending platform is crucial. Established platforms have risk management mechanisms and investor safeguards in place. They prioritize transparency and adhere to regulations, reducing the likelihood of platform-related risks.

Reinvestment for Continuous Passive Income

Understanding Reinvestment

Reinvestment in the context of Peer-to-Peer (P2P) lending refers to reinvesting the earnings and returns generated from your initial investments into new loans or lending opportunities within the same P2P lending platform.

How Reinvestment Works

When a lender receives repayments of principal and interest from borrowers in a P2P lending platform, they have two options:

Withdraw Earnings: Lenders can withdraw their earnings and use them for personal expenses or investments outside the platform.

Reinvest Earnings: Lenders can choose to reinvest their earnings by lending them to new borrowers within the same platform.

The Power of Reinvestment

Reinvestment can significantly benefit lenders in the following ways:

Compounding Returns: Reinvesting earnings allows lenders to earn returns on their initial investments and the accumulated earnings. Over time, this compounding effect can substantially increase passive income.

Continuous Cash Flow: By reinvesting, lenders maintain a consistent cash flow of interest payments and principal repayments, ensuring a steady stream of passive income.

Accelerated Growth: The compounding effect of reinvestment accelerates the growth of a lender’s portfolio, potentially leading to a more substantial passive income stream than if earnings were withdrawn.

Mitigating Inflation: Reinvestment can help counter the eroding effects of inflation on the value of money, ensuring that passive income retains its purchasing power.

Achieving Financial Goals: For investors with long-term financial goals, such as retirement planning or wealth accumulation, reinvestment is a strategic approach to achieve these objectives.

Conclusion

Peer-to-peer (P2P) lending offers individuals a lucrative avenue for passive income. This financial model enables direct lending via online platforms, yielding numerous advantages for investors.

A significant perk of P2P lending lies in reinvestment. Investors can reinvest their earnings, harnessing compounding effects to accelerate passive income growth. By continually reinvesting returns, they can maximize financial gains.

Diversification is another pivotal aspect of P2P lending. It entails spreading investments across various loans or borrowers as a risk management strategy. This diversification ensures a stable income stream, mitigating potential defaults or fluctuations in borrower performance and enhancing overall portfolio resilience.

By adhering to these prudent strategies – reinvestment and diversification, investors can cultivate financial stability and unlock higher earnings potential. P2P lending appeals to those bolstering income portfolios and pursuing sustained financial growth.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. It is recommended to consult with a financial advisor before making any investment decisions.

Frequently Asked Questions (FAQs)

P2P lending involves individuals lending money to other individuals or small businesses through online platforms, aiming to earn interest income in return.

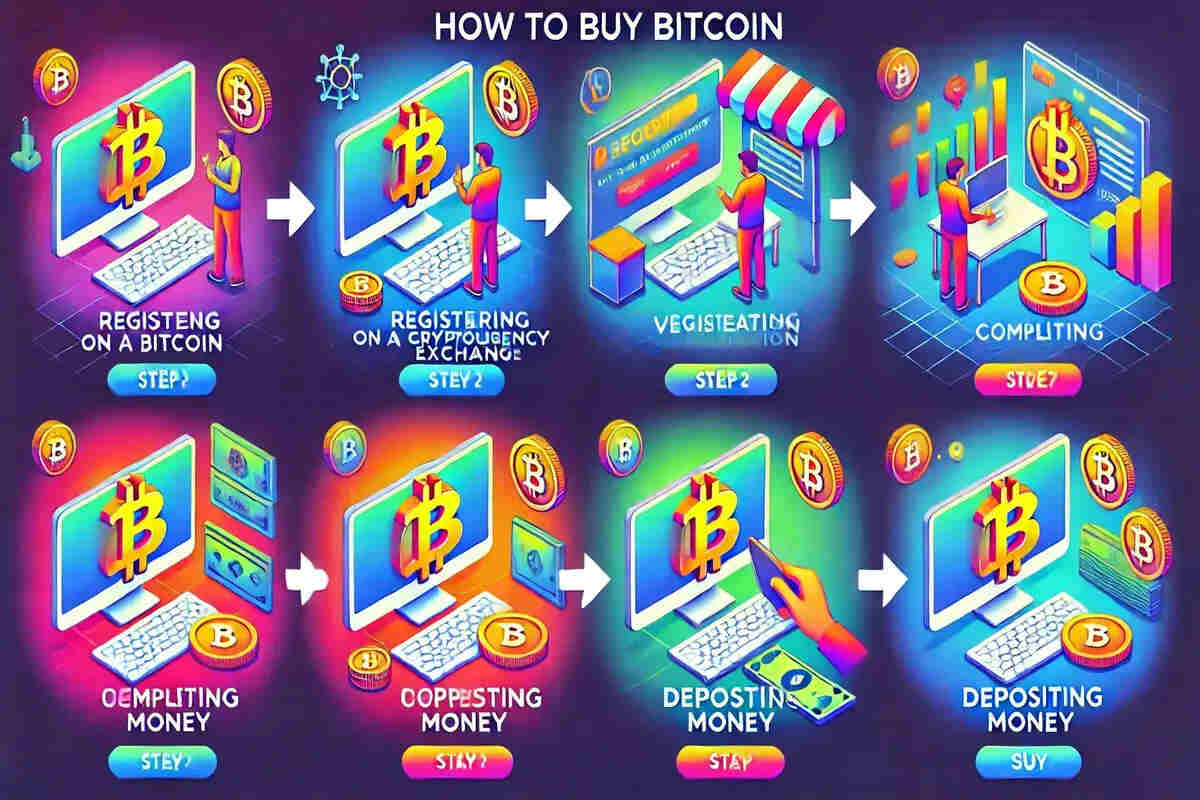

First, you must sign up on a P2P lending platform, complete the required KYC process, deposit funds, and select loans to invest in.

Returns vary but can range from 3% to 12% or more, depending on the platform, loan type, and risk level.

Risks include borrower default, platform insolvency, and lack of liquidity. Diversifying your investments and choosing reputable platforms can help mitigate these risks.

Diversification involves spreading your investments across multiple loans or borrowers to reduce the impact of defaults on your overall income.

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.