Nigeria seeks to become the African Silicon Valley. Regulators have stepped up their efforts to ensure the responsible use of emerging technology, which supports Nigeria’s technological growth. On Friday, Nigerian cybersecurity experts, including Interpol and other intelligence units, discussed addressing cyber-related crimes.

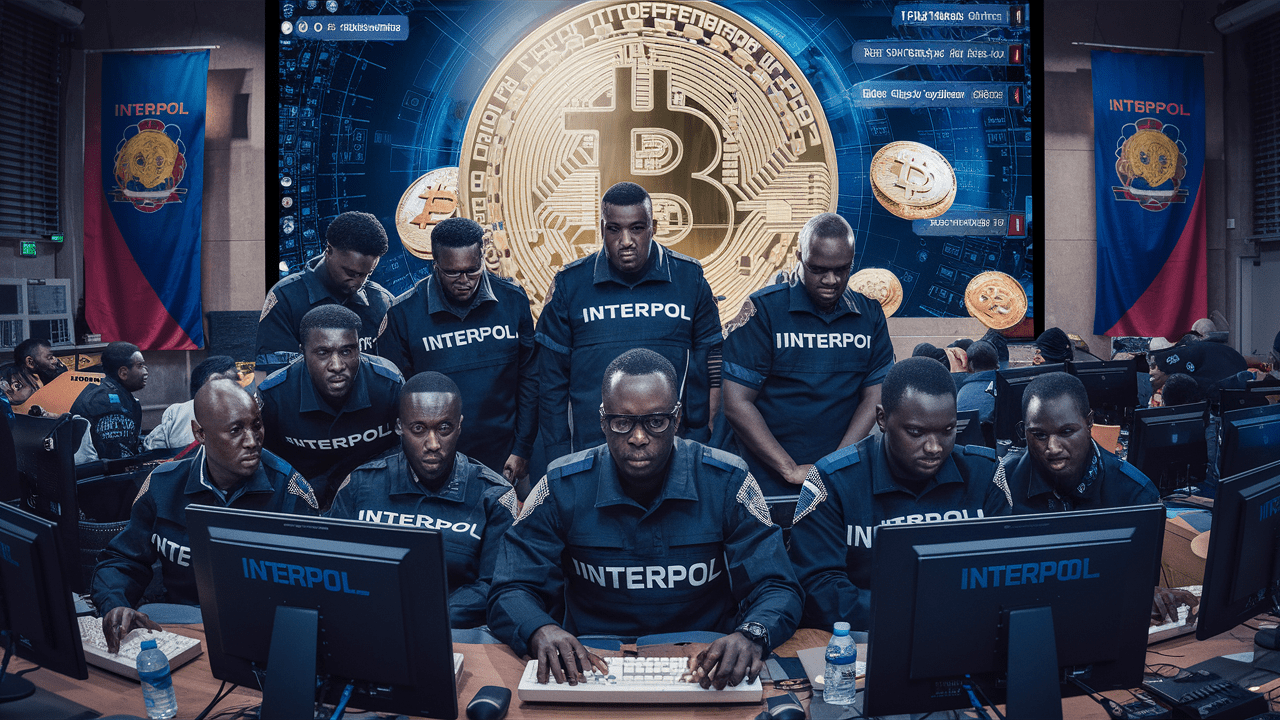

A&D Forensic facilitated the meeting in partnership with the Africa Stablecoin Consortium. According to a local news site, it aimed to equip the Nigerian Interpol team with skills to tackle crimes related to digital assets and stablecoins.

Nigerian Interpol offers cybersecurity training.

Chioma Onyekelu, a renowned blockchain specialist, made a statement. She revealed that the training was necessary. It aimed to equip Interpol law enforcers with the expertise to address cybercrime.

The executive highlighted the importance of training Nigerian law enforcers amid the tech boom. Onyekelu stated that the training offered the Interpol staff an opportunity to upskill to meet future demands.

The training equipped law enforcers with the necessary skills. They learned to leverage advanced technologies, including blockchain and artificial intelligence (AI), which helped them execute their tasks efficiently.

This will enable Interpol to trace suspicious transactions and convict criminals looming in the digital sector. Citing the growth in the adoption of crypto assets, the executive noted that criminals have transitioned from traditional finance to the crypto world.

Rise of cybercrime in Nigeria

The rise of crypto-related crimes compelled the Nigerian authority to invest in training law enforcers to mitigate wrongdoings. The training will also enable Nigerian law enforcers to collaborate with global regulators to bring criminals to justice.

Nigeria ranks as the country with the highest crypto adoption in Sub-Saharan Africa. The surge in crypto activities in West Africa has threatened the financial sector.

Therefore, the training will enable law enforcement to address crypto crimes effectively. In support of Onyekelu’s remarks, the senior partner at A&D Forensics, Adedeji Owonibi, restated that the training was important to address financial crimes involving Bitcoin and stablecoins.

Reflecting on the Nigerian regulatory framework for digital assets, the official noted that the gap between law enforcement action and cybercrime was widening. These regulatory gaps have threatened the Nigerian financial sector.

Owonibi noted that the only way to address the evolving cyber crimes was to enhance the law enforcers’ capabilities to address the menace. The executive emphasized the need to be current with emerging technologies to address crime.

Nigerian authority explores ways to mitigate crypto crime

Despite the damages caused by cybercrime in Nigeria, the government has the legal power to make informed decisions on strengthening national security. With the rise of the tech-savvy Nigerian community, the executive prioritizes national security.

The Nigerian government has developed a way to boost cybersecurity to attain a sustainable economy. In a recent announcement, the Central Bank of Nigeria (CBN) revealed that the government will impose 0.05% charges on banks and local payment platforms. This applies to any digital transaction.

The revenue generated from the digital transaction will be utilized to oversee the operations of the Office of the National Security Adviser (ONSA). Also, due to non-compliance, the Nigerian authority has actively Broken down peer-to-peer exchanges in the country.

Read More: Why Nigeria Will Ban Peer-to-Peer Crypto Transactions

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.