Estimated reading time: 7 minutes

The interest in cryptocurrencies like Bitcoin and Ethereum has significantly increased recently. These digital currencies, built on blockchain technology, offer a new way to manage and transfer value. Bitcoin, often referred to as digital gold, was the first cryptocurrency and is the most recognized. On the other hand, Ethereum extends blockchain functionalities with its smart contract feature, enabling more complex applications.

The appeal of cryptocurrencies lies in their potential for high returns on investment and the view that they are the future of finance. As the traditional financial system encounters various challenges, many people in the United Kingdom (UK) and globally consider cryptocurrencies a viable investment option.

For those in the UK interested in buying and investing in Bitcoin and Ethereum, it’s essential to understand the process. This knowledge ensures safe and effective participation in the fast-paced world of cryptocurrency.

Table of contents

Understanding Bitcoin and Ethereum

Bitcoin and Ethereum stand at the forefront of the cryptocurrency movement, each serving distinct roles within the digital finance landscape. Bitcoin, launched in 2009 by the enigmatic figure Satoshi Nakamoto, functions primarily as a peer-to-peer electronic cash system and a store of value. It is built on a decentralized blockchain secured by Proof of Work (PoW) and is notable for its limited supply of 21 million coins, which supports its value over time.

On the other hand, Ethereum was introduced by Vitalik Buterin in 2015 and extends the application of blockchain technology beyond simple financial transactions. It is a platform for smart contracts and decentralized applications (DApps), with Ether (ETH) as its native currency to handle transaction fees and operational costs. Ethereum is distinguished by its ongoing developments toward blockchain scalability and a planned transition from Proof of Work (PoW) to a Proof of Stake (PoS) consensus model, aiming for greater energy efficiency.

These two cryptocurrencies have captured significant attention for their potential to yield substantial investment returns and are increasingly viewed as integral components of the future financial ecosystem. As interest grows, particularly in the United Kingdom, understanding how to purchase and invest in Bitcoin and Ethereum securely is crucial for individuals looking to navigate the cryptocurrency market effectively.

Differences and Use Cases

Differences

Bitcoin and Ethereum serve distinct purposes within the digital asset ecosystem. Bitcoin is primarily a digital currency, focusing on providing a secure and decentralized store of value. Its blockchain is noted for its simplicity and finite supply.

On the other hand, Ethereum offers a flexible platform for decentralized applications (DApps), incorporating smart contracts that enable a wide range of applications beyond simple transactions. Ethereum is also transitioning to a Proof of Stake (PoS) consensus mechanism, aiming to reduce the environmental impact of the energy-intensive Proof of Work (PoW) protocol.

Use Cases

Bitcoin is often seen as a digital alternative to gold, acting as an inflation hedge and a decentralized method for transferring value worldwide. It offers a level of financial independence from traditional banking systems.

With its capability to support smart contracts, Ethereum is pivotal in developing decentralized finance (DeFi) applications, non-fungible tokens (NFTs), and many other blockchain-based solutions. This adaptability makes it a cornerstone for innovative financial instruments and services and a platform for unique digital asset exchange and application development across various sectors.

Importance of Research Before Investing

Investors considering Bitcoin or Ethereum should conduct comprehensive research to understand their distinct use cases, associated risks, and potential benefits. Keeping abreast of market trends, technological updates, and regulatory changes is crucial.

An in-depth evaluation of personal investment goals and risk tolerance is necessary to align investments with financial objectives and manage the risks inherent in cryptocurrency investments. Educated decision-making and risk management are key to navigating the complex cryptocurrency market.

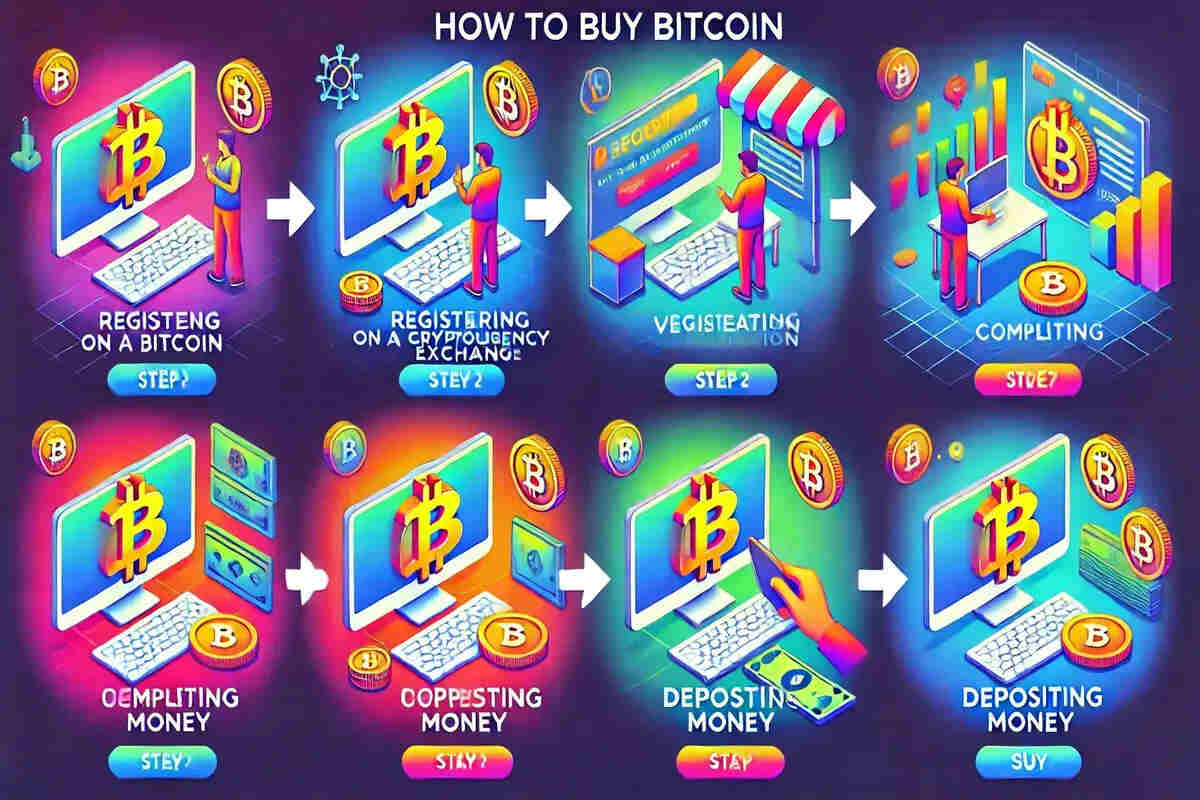

Buying Bitcoin in the UK

To trade Bitcoin, starting with a cryptocurrency exchange account is essential.

Choose a Reputable Crypto Exchange

Selecting a trustworthy cryptocurrency exchange operating in the UK is crucial. Platforms like eToro, Kraken, or Coinbase are recommended based on user feedback and security measures.

Sign Up and Verify Your Identity

Initiating the process requires visiting the chosen exchange’s website to sign up. Providing accurate information and setting up two-factor authentication enhances account security. This step is vital for protecting transactions and personal data.

KYC Verification

Exchanges require Know Your Customer (KYC) verification to comply with regulations and ensure account security. Following the platform’s instructions for document submission is important. This usually involves a photo ID and proof of residence. Clear and precise documentation facilitates the verification process. Ensuring that account details match the provided documents is critical for regulatory compliance and a secure trading experience.

Deposit Funds

Following KYC approval, adding GBP or any fiat currency to an account is simple.

- Head to the “Deposit” or “Funds” area within the account.

- Select a preferred payment option, such as bank transfers or credit cards.

- Adhere to the instructions on the screen, including the amount, and verify the details before proceeding.

Tips to Consider When Depositing

Be aware of any deposit fees, which can vary depending on the payment method chosen. Knowing these fees beforehand aids in making informed choices.

Acknowledge the processing times associated with each payment option, as they vary. Being informed about these times helps in selecting the most suitable method.

Check for any minimum deposit limits imposed by the platform. Ensuring these limits are met guarantees a smooth deposit process.

Recheck bank information before finalizing the deposit to prevent any discrepancies. Accuracy is key to ensuring a successful transaction.

Start Trading Bitcoin

Once funds are added, one can begin trading Bitcoin. Utilize the exchange’s features to place buy or sell orders that align with trading strategies.

Trading requires a cautious approach due to the risks involved. Employing stop-loss orders to sell assets at a set price automatically can minimize losses. This strategy is essential for managing risk and protecting investments. Making informed decisions is crucial in navigating the volatile Bitcoin trading environment.

Buying Ethereum in the UK

Choosing a Reputable Crypto Exchange

For individuals in the UK interested in purchasing Ethereum, selecting a trustworthy cryptocurrency exchange is crucial. Coinbase, Binance, and Kraken stand out due to their reliability and user-friendly platforms.

Signing Up for an Account

To initiate, one should visit the website of the chosen exchange and opt for the “Sign Up” or “Create Account” option. It requires entering an email address, setting a secure password, and providing necessary personal details.

Verifying Your Identity

UK regulations necessitate identity verification to enhance security on cryptocurrency exchanges. This process, known as Know Your Customer (KYC), involves submitting a government-issued photo ID (passport or driver’s license) and proof of address (utility bill or bank statement). It is vital to ensure that the information on these documents matches the provided details and that they are clear, legitimate, and current.

Setting Up Two-Factor Authentication (2FA)

Enhancing account security through two-factor authentication (2FA) is highly recommended. This can be achieved using an authenticator app like Google Authenticator or by opting for security codes via SMS. 2FA is an additional protective measure, securing the account from unauthorized access.

Depositing Funds

Following successful account verification, users can deposit funds by navigating to the “Deposit” or “Funds” section of the exchange. Choosing a preferred payment method, such as bank transfer or debit/credit card, is necessary. Users must follow the provided instructions carefully to ensure accurate completion of the deposit process.

Buying Ethereum (ETH)

With funds deposited, users can proceed to purchase Ethereum. This is done by accessing the trading section and selecting an Ethereum (ETH) trading pair, like ETH/GBP. Reviewing the order details thoroughly before confirmation is important to ensure a smooth transaction.

Securing Your Holdings

Transferring Ethereum to a secure wallet, either hardware or software is advisable for enhanced security. This method provides greater security compared to storing assets on the exchange.

Starting Trading

With Ethereum purchased and secured, users are prepared to trade on the exchange. Leveraging the platform’s trading features allows for buying, selling, or holding Ethereum based on the individual’s investment strategy.

Conducting thorough research, employing security measures such as 2FA, and opting for a reputable exchange is essential for a secure and effective Ethereum trading experience in the UK.

Related: What You Should Know: Bull And Bear Market Dynamics

Frequently Asked Questions (FAQs)

Bitcoin is a digital or virtual currency that allows peer-to-peer transactions without the need for intermediaries like banks.

While Bitcoin has gained popularity as a digital asset, it carries inherent risks. It’s essential to conduct thorough research, use secure wallets, and be cautious of scams to minimize risks associated with investing in Bitcoin.

Ethereum is a blockchain platform that enables the creation of smart contracts and decentralized applications (DApps).

KYC, or Know Your Customer, is a process that cryptocurrency exchanges use to verify the identity of their users. Users must provide identification documents to comply with regulatory standards and prevent illegal activities.

Cryptocurrency trading carries several risks, including market volatility, security threats, and regulatory changes.

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.