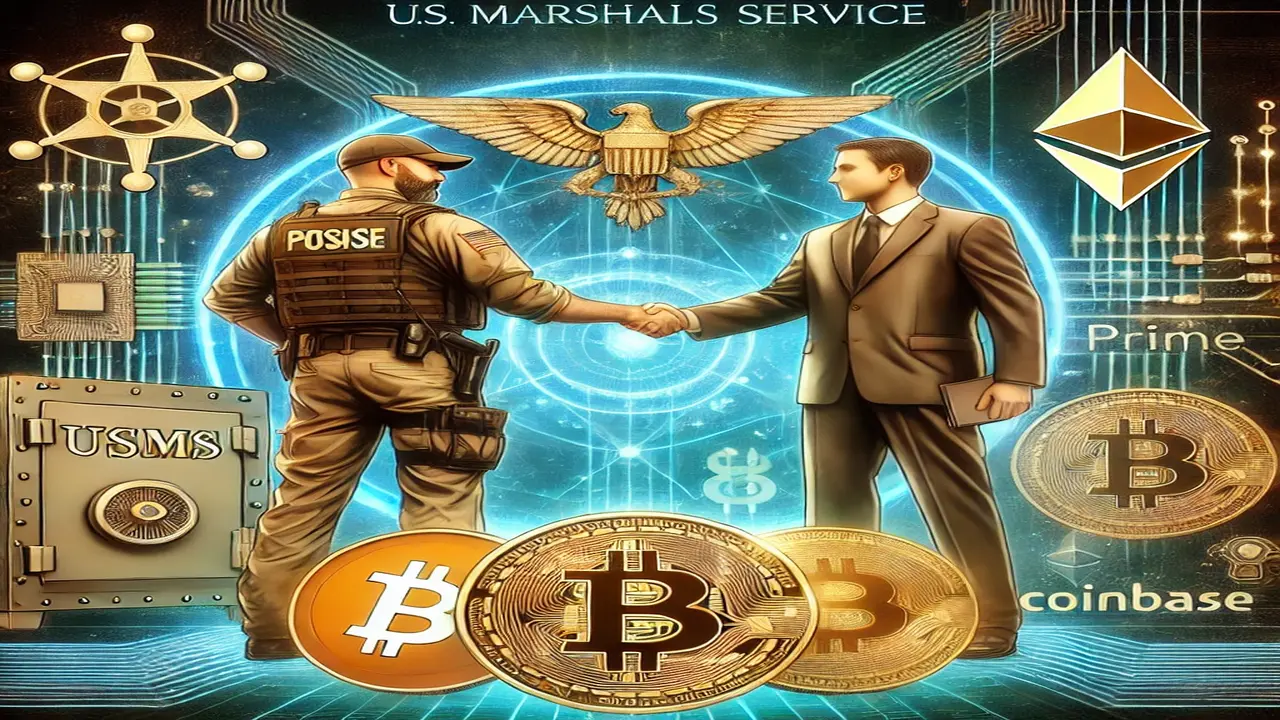

Coinbase and the U.S. Marshals Service have announced a new partnership. Brian Foster, head of wholesale at Coinbase, tweeted that they had confirmed securing a $32.5 million contract. This contract will provide advanced custodial services for seized cryptocurrencies, significantly improving the security of these digital assets.

DOJ’s U.S. Marshals Service signs contract with Coinbase Prime

The U.S. Marshals Service (USMS) has selected Coinbase Prime in a significant agreement for custodial and advanced trading services. Valued at $32.5 million, this contract underscores the government’s trust in its capability to securely manage and liquidate large volumes of digital assets. This decision supports the USMS’s goal to implement state-of-the-art digital asset management solutions following DOJ standards and policies.

In a blog post, Coinbase highlights its robust history of collaborating with law enforcement agencies since establishing its dedicated program in 2014. Hence, they are partnering closely with all significant U.S. federal, state, and local law enforcement bodies, alongside international agencies worldwide. These alliances are to play a pivotal role in advancing safe and efficient markets, which is vital to their commitment to fostering the growth of the crypto economy.

Secure and reliable custodial service

The USMS conducted a thorough assessment of custodial solutions before choosing Coinbase. Coinbase was selected for its institutional-grade security and expertise in cryptocurrency services. The agency sought a platform capable of managing, securing, and liquidating large volumes of digital currency while meeting strict regulatory and security standards. This agreement highlights Coinbase’s credibility and proficiency in the digital asset industry.

Coinbase, known for its trust among institutional clients, confronts concurrent legal challenges. The SEC has sued Coinbase for allegedly operating unregistered securities services. In response, Coinbase has countersued federal agencies, including the SEC, arguing they unfairly push crypto firms away from traditional banking systems. These legal disputes underscore the regulatory uncertainties cryptocurrency companies navigate in the U.S.

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.