Bitcoin, the world’s first cryptocurrency, has transformed the financial landscape since its inception in 2009. Created by an anonymous figure or group known as Satoshi Nakamoto, Bitcoin allows peer-to-peer transactions without intermediaries like banks. This guide provides a comprehensive, step-by-step roadmap for purchasing Bitcoin, catering to beginners and seasoned investors.

Bitcoin is a decentralized digital currency that operates on blockchain technology. Unlike traditional currencies issued by governments and central banks, Bitcoin is entirely digital and decentralized. This means it is not controlled by any single entity, making it resistant to censorship and inflation.

Bitcoin’s value is driven by supply and demand dynamics. Its finite supply is capped at 21 million coins. This scarcity and increasing adoption and recognition have contributed to its value appreciation over time.

Related Post: Bitcoin Price Prediction 2024-2033

Choosing a Crypto-Trading Service or Venue

Selecting the right crypto-trading service or venue is the foundational step in your Bitcoin buying journey. The choice of platform can significantly influence your overall experience, impacting everything from ease of use and transaction speed to security and fees. Given the growing number of exchanges with unique features and offerings, it’s crucial to understand the criteria for making an informed decision.

Cryptocurrency exchanges act as digital marketplaces where you can buy, sell, and trade Bitcoin and other digital assets. They provide the infrastructure for transactions and often include additional services such as wallets, market analysis tools, and educational resources. The right exchange should align with your specific needs, whether you’re a beginner looking for a simple interface or an experienced trader seeking advanced features.

Why Choosing the Right Exchange Matters

Security: Ensuring the safety of your funds is paramount. Reputable exchanges employ robust security measures, including encryption, two-factor authentication (2FA), and cold storage solutions to protect user assets from hacks and breaches.

User Experience: A user-friendly interface can make the buying process smoother, especially for newcomers. Intuitive design and clear instructions can significantly reduce the learning curve.

Fees: Different exchanges have varying fee structures, including trading fees, deposit and withdrawal fees, and transaction fees. Understanding these costs is essential for maximizing your investment returns.

Payment Methods: The availability of multiple payment options, such as bank transfers, credit/debit cards, and even PayPal, can provide flexibility and convenience in funding your account.

Liquidity: High liquidity on an exchange means you can buy and sell Bitcoin quickly without significant price changes. This is particularly important for traders looking to capitalize on market movements.

Reputation: Trustworthy exchanges have a proven track record of reliability and customer satisfaction. User reviews, industry endorsements, and the exchange’s history of handling security incidents can offer valuable insights.

By carefully evaluating these factors, you can select a crypto-trading service or venue that best meets your needs, providing a secure and efficient environment for your Bitcoin transactions. Here are some of the most popular platforms that cater to various user requirements:

Popular Exchanges

Coinbase: Known for its user-friendly interface and strong security features. Ideal for beginners.

Binance: Offers a wide range of cryptocurrencies and advanced trading features. Suitable for more experienced traders.

Kraken: Known for its security and transparency. Offers a range of cryptocurrencies and trading options.

Bitfinex: Provides advanced trading features and high liquidity. Suitable for professional traders.

Each of these exchanges has unique strengths, catering to different types of users, from novices to seasoned investors. Selecting the right one sets the stage for a smooth and secure Bitcoin buying experience.

Related Post: How does Bitcoin work?

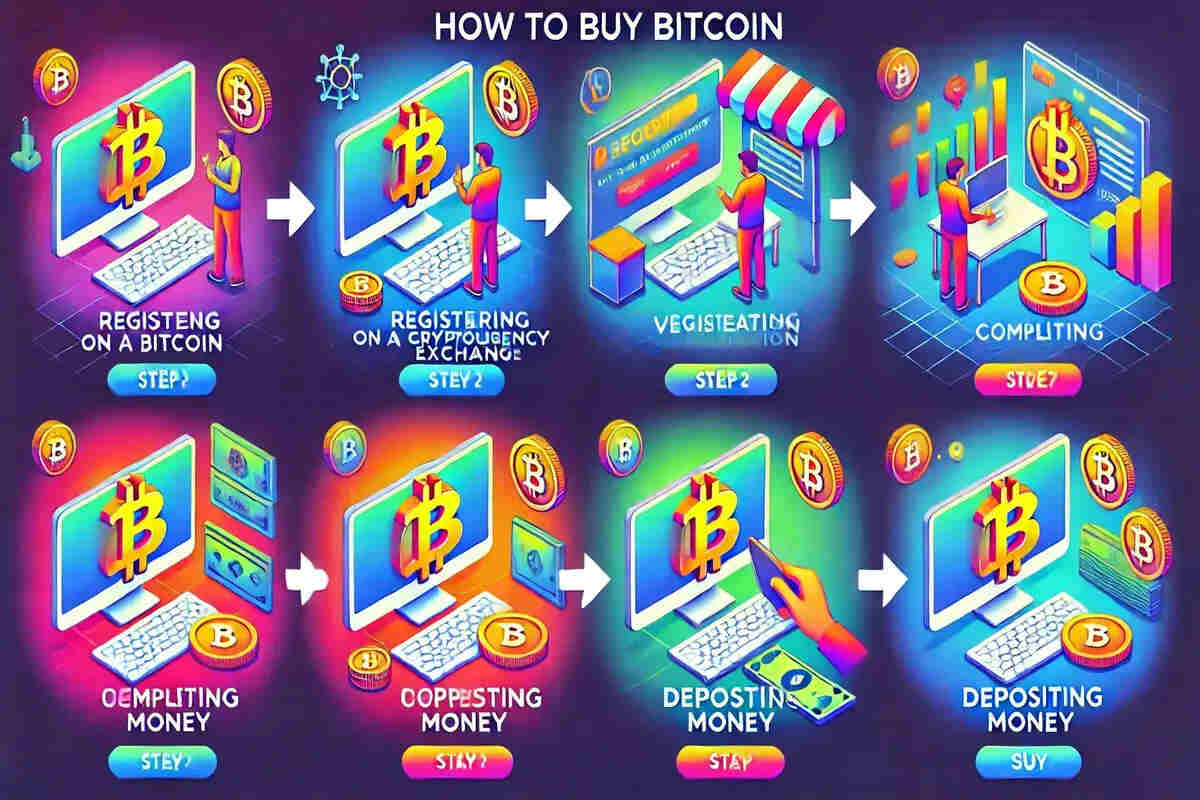

Creating a Bitcoin Account

After selecting a crypto exchange, the next critical step is to create an account. This process is designed to establish your identity on the platform, ensure the security of your transactions, and comply with regulatory requirements. Creating an account involves several important steps, such as safeguarding your assets and personal information.

Why Account Creation is Important

Security: Establishing a secure account with a strong password and multi-factor authentication helps protect against unauthorized access and potential breaches.

Regulatory Compliance: Crypto exchanges must adhere to legal standards, such as anti-money laundering (AML) and know-your-customer (KYC) regulations. These measures help prevent illegal activities and enhance the platform’s integrity.

Access to Services: Creating an account provides access to the exchange’s full range of services, including buying, selling, and trading cryptocurrencies. You can also utilize various tools and resources provided by the platform.

Registration Process

Sign Up: Visit the exchange’s website and locate the “Sign Up” or “Register” button, usually prominently displayed on the homepage. Click this button to initiate the registration process.

Provide Details: Enter the necessary information, typically your email address and a secure password. Ensure your password is strong, using a mix of letters, numbers, and special characters to enhance security.

Verify Email: After submitting your details, the exchange will send a verification email to the address provided. Check your inbox for this email and click the verification link to confirm your registration.

Identity Verification (KYC)

To comply with global financial regulations and to enhance security, most reputable exchanges require users to complete a Know Your Customer (KYC) process. This involves several steps to verify your identity:

Uploading Identification: You must provide a government-issued ID, such as a passport or driver’s license. This helps verify your identity and prevent fraudulent activities.

Selfie Verification: Some exchanges require a selfie for additional verification. This step ensures that the person creating the account matches the ID provided.

Proof of Address: To further confirm your identity, you may be asked to upload a document that verifies your address, such as a utility bill, bank statement, or lease agreement. This helps prevent identity theft and ensures compliance with legal requirements.

Timeline for Verification

The KYC process can vary in duration depending on the exchange. While some platforms offer instant verification, others may take a few days to review and approve your documents. During this period, it is important to monitor your email for any updates or additional requests from the exchange.

Creating an account on a cryptocurrency exchange is a foundational step that sets the stage for your Bitcoin buying experience. Following these steps carefully ensures a secure and compliant entry into cryptocurrency trading.

Related post: How to buy Bitcoin in Dubai

Deposit Funds

Once you have set up and verified your account on a cryptocurrency exchange, the next crucial step is to deposit funds. This process involves transferring money from your bank account or another funding source into your exchange account, enabling you to buy Bitcoin and other cryptocurrencies.

The method you choose for depositing funds can influence the transaction’s speed, cost, and convenience, making it essential to understand the available options.

Importance of Depositing Funds

Enable Transactions: Depositing funds is a prerequisite for buying Bitcoin. You won’t be able to make any purchases without sufficient funds in your exchange account.

Flexibility in Trading: Having funds readily available in your account allows you to take advantage of favorable market conditions and execute trades quickly.

Variety of Methods: Exchanges offer multiple payment methods to cater to different preferences and needs, from traditional bank transfers to modern digital payment solutions.

Payment Methods

Exchanges typically support a variety of payment methods to make depositing funds as convenient and accessible as possible:

Bank Transfer: This is a secure and widely used method. Although the funds may take a few days to clear, larger deposits are generally preferred due to lower fees.

Credit/Debit Card: This method allows instant deposits, making it ideal for quick transactions. However, it may have higher fees than bank transfers.

Some exchanges support PayPal, offering a fast and convenient way to deposit funds. This is particularly useful for users who already have a PayPal account.

Cryptocurrency Transfer: If you own other cryptocurrencies, you can deposit them directly into your exchange account. This method is quick and cost-effective, depending on the exchange’s policies and the network fees of the transferred cryptocurrency.

Steps to Deposit

To deposit funds into your exchange account, follow these steps:

Navigate to Deposit Section: Log in to your exchange account and locate the deposit section. This is usually found in the account dashboard or wallet section.

Select Payment Method: Choose your preferred payment method from the available options. Each method will have specific instructions and requirements.

Enter Amount: Specify the amount you wish to deposit. Ensure you meet any minimum deposit requirements set by the exchange.

Follow Instructions: Complete the deposit process by following the on-screen instructions. This may involve entering bank details and card information or initiating a cryptocurrency transfer.

Confirm Deposit: Once the deposit is successful, you will receive a confirmation message, and the funds will be credited to your exchange account. The processing time will vary depending on the payment method used.

Step 4: Buy Bitcoin

With funds securely deposited in your exchange account, the next exciting step is to buy Bitcoin. This process involves navigating the exchange’s trading platform, understanding the different types of orders, and executing your purchase. Buying Bitcoin is straightforward, but it’s important to familiarize yourself with the platform’s interface and the various order options to ensure you get the best deal and execute your transactions effectively.

Why Buying Bitcoin is a Critical Step

Investment Entry: Purchasing Bitcoin marks your entry into cryptocurrency investment. It’s a significant step towards diversifying your portfolio and potentially benefiting from the growth of digital assets.

Market Participation: By buying Bitcoin, you actively participate in the cryptocurrency market, gaining exposure to its price movements and opportunities.

Strategic Planning: Understanding how to place different types of orders allows you to strategize and optimize your buying process, ensuring you buy Bitcoin at your desired price points.

Navigating the Trading Section

Before buying Bitcoin, you must familiarize yourself with the trading section of the exchange. This is where all buying, selling, and trading activities take place. Exchanges often label this section “Buy/Sell” or “Trade.”

Access Trading Platform: Log in to your exchange account and navigate the trading section. This is typically accessible from the main dashboard or through a dedicated menu item.

Select Bitcoin (BTC): Once in the trading section, select Bitcoin from the list of available cryptocurrencies. This will bring up the trading interface specific to Bitcoin, which will show you current prices, market depth, and other relevant data.

Understanding Order Types

There are several types of orders you can place when buying Bitcoin. Each serves a different purpose and can help you execute your strategy effectively:

Market Order: A market order buys Bitcoin at the current market price. This type of order is executed immediately, making it ideal for quick purchases when you want to buy Bitcoin without delay.

Limit Order: A limit order sets a specific price at which you want to buy Bitcoin. The order will only be executed if the market price reaches your specified price, allowing you to buy Bitcoin at your desired rate.

Stop-Loss Order: While primarily used to sell assets to minimize losses, understanding stop-loss orders is beneficial. These orders automatically sell your Bitcoin if the price falls to a certain level, protecting your investment from significant drops.

Executing the Purchase

Once you understand the types of orders, you can proceed to execute your purchase:

Enter Amount: Specify the amount of Bitcoin you want to buy or the amount of fiat currency you want to spend. Most exchanges will allow you to enter either the quantity of Bitcoin or the total investment in your local currency.

Review Order: Carefully review your order details, including the price, total cost, and applicable fees. Ensuring everything is correct before confirming helps avoid mistakes.

Confirm Purchase: Click the “Buy” or “Confirm” button to execute your transaction. The exchange will process your order based on the type you selected, and once completed, your Bitcoin will be credited to your account.

Also Read: Who controls Bitcoin

Secure Your Bitcoin

Purchasing Bitcoin is just the beginning of your cryptocurrency journey. To protect your investment, it is crucial to store your Bitcoin securely. The most secure way to store Bitcoin is in a private wallet where you control the private keys. Private keys are the passwords that give you access to your Bitcoin. You must move or spend your Bitcoin with them, making their security paramount.

Importance of Secure Storage

Ownership and Control: Storing Bitcoin in a private wallet ensures that you have full control over your funds. The adage “Not your keys, not your Bitcoin” underscores the importance of controlling your private keys.

Protection Against Hacks: Exchanges, despite their security measures, are still susceptible to hacks. Transferring your Bitcoin to a private wallet significantly reduces this risk.

Preventing Loss: Secure storage solutions prevent accidental loss or theft, ensuring your Bitcoin remains accessible and protected.

Types of Wallets

Various types of wallets are available, each offering different levels of security and convenience. Here are the most common types:

Hardware Wallets: These are physical devices that store your private keys offline, providing the highest level of security. Examples include Ledger Nano S and Trezor. Hardware wallets are immune to online hacks and malware, making them ideal for long-term storage.

Software Wallets: These are applications or software programs that store your keys on your computer or smartphone. Examples include Electrum and Mycelium. While more convenient than hardware wallets, they are still vulnerable to malware and hacking attempts.

Paper Wallets: These are physical printouts of your private and public keys. They offer an offline storage method, which is secure from online threats but susceptible to physical damage or loss. Proper care must be taken to protect paper wallets from fire, water, and other physical risks.

Web Wallets: These are online services that store your keys online. Examples include Blockchain.com and Coinbase. They offer convenience and ease of access but could be more secure due to their exposure to online vulnerabilities and the potential for phishing attacks.

Transferring Bitcoin to Your Wallet

Once you have chosen your preferred type of wallet, you need to transfer your Bitcoin from the exchange to your wallet. Here’s how to do it:

Obtain Wallet Address: Open your wallet application and generate a new Bitcoin address. This address is a string of alphanumeric characters representing your wallet’s location on the blockchain.

Initiate Transfer: Log in to your exchange account and navigate the withdrawal section. This is where you will transfer your Bitcoin to your wallet.

Enter Wallet Address: Carefully paste the wallet address you generated into the designated field on the exchange. Double-check the address to ensure it is correct, as sending Bitcoin to the wrong address can result in permanent loss.

Specify Amount: Enter the amount of Bitcoin you wish to transfer. You can choose to transfer the entire balance or a specific portion.

Confirm Transfer: Review all the details, including the wallet address and the amount. Once you are sure everything is correct, confirm the transfer. The Bitcoin will be sent from your exchange account to your wallet.

Best Practices for Wallet Security

To further enhance the security of your Bitcoin, follow these best practices:

Enable Two-Factor Authentication (2FA): To add an extra layer of security, use 2FA for both your exchange and wallet accounts.

Use Strong, Unique Passwords: Ensure your passwords are complex and not reused across multiple sites. Consider using a password manager to keep track of them.

Regular Backups: Regularly back up your wallet and store the backup securely. This ensures you can recover your funds in case of hardware failure or other issues.

Stay Updated: Keep your wallet software and devices updated with the latest security patches to protect against vulnerabilities.

Be Cautious of Phishing: Always verify the authenticity of emails and websites. Avoid clicking on suspicious links or providing personal information to unverified sources.

Monitor and Manage Your Investment

After purchasing Bitcoin, it’s essential to monitor your investment to ensure it aligns with your financial goals. Effective management involves using the right tools, regularly reviewing your strategy, and staying informed about market and regulatory developments.

Portfolio Tracking

- Use Tracking Apps: Utilize apps like Blockfolio, Delta, and CoinTracking to monitor your portfolio. These apps provide real-time updates on the value of your investments and track the performance of your Bitcoin holdings.

- Set Price Alerts: Configure alerts for significant price changes. This helps you stay informed about market movements and make timely decisions regarding buying or selling.

Reviewing Investment Strategy

- Regular Reviews: Periodically reassess your investment strategy. Consider how your Bitcoin holdings fit into your overall financial plan and adjust based on market trends and personal financial goals.

- Diversification: Explore other cryptocurrencies or traditional assets to diversify your investments. Diversification can reduce risk and enhance the stability of your portfolio.

Staying Informed

- Market News: Follow reliable cryptocurrency news sources and market analyses. Staying updated on the latest developments helps you understand factors that may influence Bitcoin’s price and market sentiment.

- Regulatory Changes: Keep abreast of regulatory changes in your region and globally. Regulatory shifts can significantly impact the cryptocurrency market, influencing short-term volatility and long-term viability.

By actively monitoring and managing your Bitcoin investment, you can navigate the volatile cryptocurrency landscape more effectively, making informed decisions to optimize your returns and minimize risks.

Conclusion

Buying Bitcoin involves several critical steps designed to ensure a secure and informed investment. Every phase requires careful consideration, from selecting a reputable crypto exchange and creating an account to depositing funds and executing the purchase.

It’s essential to understand different order types, navigate the trading platform efficiently, and, most importantly, secure your Bitcoin in a private wallet where you control the private keys. This protects your investment from potential hacks and other security threats.

Ultimately, purchasing Bitcoin is just the beginning. As you enter the world of cryptocurrencies, continuous learning and vigilance are key. Staying updated on market trends, understanding regulatory changes, and following best security practices will help you manage and grow your investment.

Following the comprehensive steps outlined in this guide, you can confidently navigate the Bitcoin buying process and position yourself for success in the dynamic and evolving cryptocurrency market.

FAQs

1. What is the safest way to store Bitcoin?

The safest way to store Bitcoin is in a hardware wallet, such as Ledger Nano S or Trezor. These wallets keep your private keys offline and secure from online threats.

2. How long does it take to buy Bitcoin?

The time to buy Bitcoin varies but typically takes a few minutes to an hour, depending on the verification process of your chosen exchange and the payment method used.

3. Are there fees associated with buying Bitcoin?

Yes, most exchanges charge transaction fees, which can include trading, deposit, and withdrawal fees. These fees vary by exchange and payment method.

4. Do I need to verify my identity to buy Bitcoin?

Most reputable exchanges require identity verification (KYC) to comply with regulations and prevent fraud. This usually involves uploading an ID and proof of address.

5. Can I buy a fraction of a Bitcoin?

Yes, Bitcoin is divisible, and you can buy fractions of a Bitcoin. This allows you to invest any amount of money you are comfortable with.

Discover more from The African Crypto

Subscribe to get the latest posts sent to your email.